Spotlights

Quantitative Analyst, Quantitative Researcher, Quantitative Developer, Quantitative Strategist, Financial Engineer, Risk Model Developer, Algorithmic Trader, Quantitative Investment Analyst, Data Scientist (with a focus on quantitative modeling), Financial Quantitative Developer

A Quantitative Model Developer or “Quant” is an individual who uses computer modeling to process data. This data is used to make decisions for a company or financial firm in order to determine risk assessments, pricing, or investment opportunities. They may have different specific duties depending on their company or industry, but all use scientific methods to analyze data.

- Excellent compensation

- Field is growing – an opportunity to be a part of a growing field.

- Able to work independently and deliver data as needed.

A typical day can depend greatly on where a Quant is working. Each company or firm may have different daily expectations for these individuals. However, you can expect the following:

- Meeting with other analysts via text, phone, teleconference, email, or in person to determine best use of data.

- Create programs to process historical and investment data – including collecting data.

- Study trends in financial markets and industry.

- Use data to assist in assessing other team members

- Create reports and presentations.

Much of the work of a Quant is computer based and you must be well versed in not only finance but computer programming as well.

- Critical Thinking

- Excellent reading comprehension and active listening.

- Complex Problem Solving

- Math – through statistics and calculus.

- Engineering knowledge.

- Analytical Software such as MATLAB

- Coding Software and Language such as Visual Basic, Python, C++

- Planning software for companies

- Database software

- Investment Banks

- Hedge Funds

- Sell-side Firms

- Insurance Firms

- Financial Software Developers

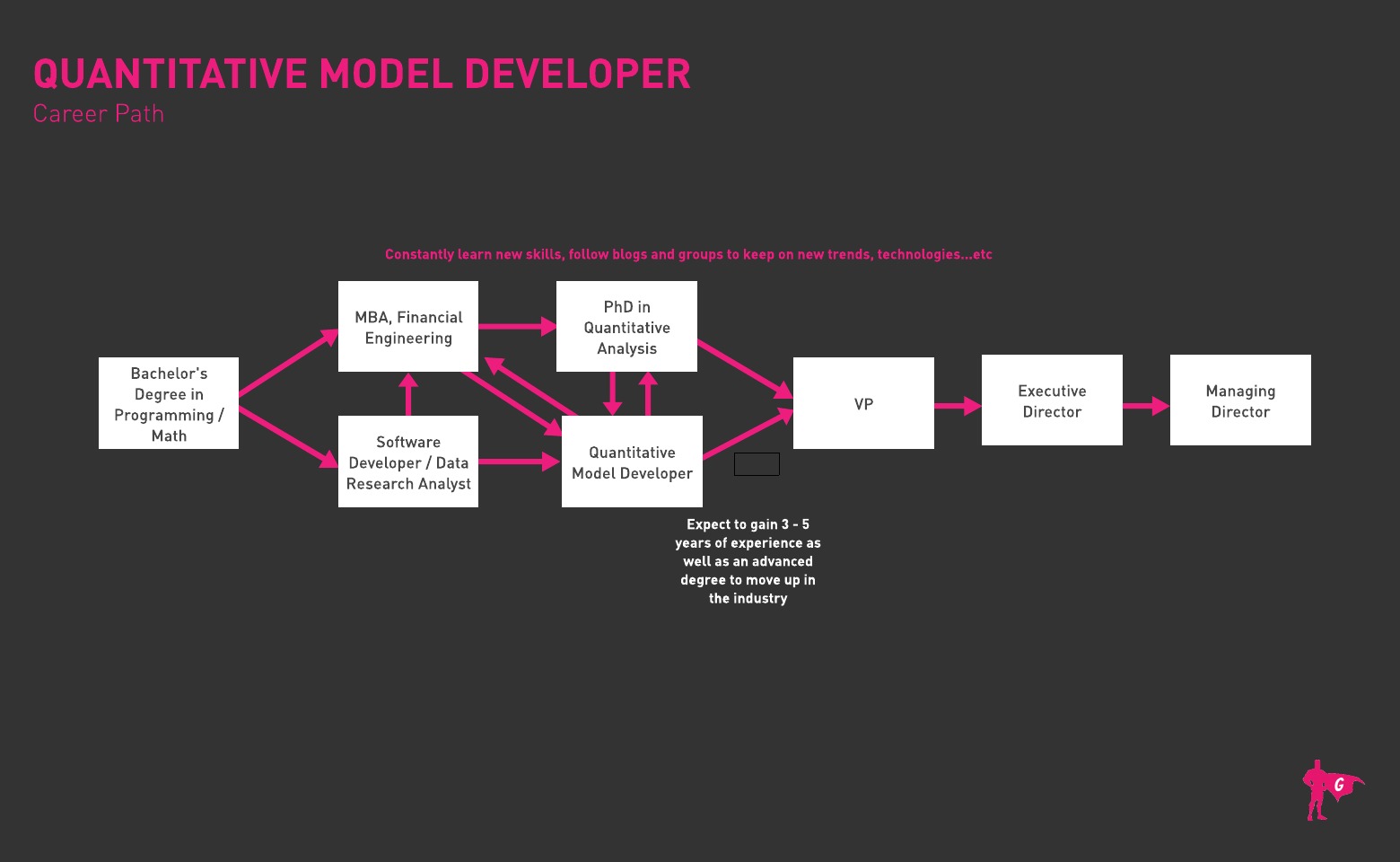

Becoming a Quantitative Model Developer can take several years of education and experience. Emphasis is often on the programming side of the equation, but it is important to be well versed in finance as well.

You will be expected to be fluent in programming languages such as C++ and Python and also to be able to develop software for your company. Analysis programs are often developed in house and proprietary. This means you can spend several years fine-tuning a program for a company and lose all access when you leave – you won’t own what you create.

You can expect to spend a lot of time honing your computer programming and software skills before finding a job in financial markets as a quant.

Quantitative development is a trend in Finance on its own. Financial markets are relying more and more on data analysis and software solutions to developing investment plans and products for their clients. As the emphasis grows, it is still unknown if more programmers will be needed to further develop software, or if fewer will be needed to maintain.

- Computer programming

- Playing video games

- Math in school

- Solving logic puzzles

- Bachelor’s Degree – Computer Programming, Software Development, Math

- Financial Classes are a plus

- Master’s – MBA, Financial Engineering, Quantitative Financial Modeling

- Experience as data analyst and with data mining can be considered instead of education.

- Ph.D – If moving up in the industry, many individuals obtain a Ph.D

- Quantitative Model Developers must also gain a practical education via a few years of work experience to learn about: derivatives, hedging programs, derivatives pricing models, market data processing, numerical techniques, non-standard pricing options, advanced quantitative application development, database programming, algorithms, scientific computing, applied mathematics, statistical models, advanced finance concepts, and data structures

- Common programming languages you may need to learn with include C++ / C#, Python, SQL, R, and VBA

- Workers should probably also be familiar with Microsoft Office automation, NumeriX Cross Asset or SDK, PolyPaths, Bloomberg, Calypso, and Tableau

- Other modeling and trading strategy tools include Maygard, Quantcode, Rosetta code, Quantconnect, Quandl, Quant Lib, and JQuantLib

- Quantitative Model Developers must develop a range of technical skills related to software development, programming, machine learning, and deep learning. Take classes, self-study, and join computer clubs to learn all you can

- Sign up for communications-related classes such as English, writing, speech, and debate

- Study common models used in quantitative development, such as consolidation, option pricing, forecasting, Discounted Cash Flow, and merger

- Apply for Quant Developer internships to start getting hands-on work experience

- Study applicable programming languages and modeling/trading tools (see the Education Required section)

- Sign up for short courses like Quantra’s Automated Trading using Python & Interactive Brokers or Machine Learning & Deep Learning in Financial Markets

Most Quants do not get their job directly out of undergraduate. Expect to spend several years working in data research or software development. Working in the financial field is not as important as demonstrating skill in data analysis. It is important to build your network during this time as there can be a great deal of crossover between a financial data modeling firm and a software development firm.

It is also highly recommended to obtain a Master’s Degree. Financial Engineering is a helpful field, as is Business Administration. Some schools offer a degree in Quantitative Analysis as well. You will need to demonstrate this knowledge as well as a willingness to take risks and meet the demands of financial traders. This means long hours and stressful conditions.

Depending on your education and experience, you can expect to work as an associate for several years. If you have a Master’s or Ph.D, you have a much better chance of moving up to a Vice President position. Beyond that, you can capitalize on your position to work at a different firm or get promoted to executive director or Vice President.

Many individuals will stay at the VP level, but you might be able to move up to Managing Director or further based on your ambition.

Websites

- Barron’s

- Bloomberg

- CNBC Breaking Business News

- Fiduciary & Investment Risk Management Association

- Financial Times

- Fox Business

- Geeks for Geeks

- International Association of Quantitative Finance

- Investopedia

- MarketWatch

- Quantinsti

- Quantivity

- Quantocracy

- QuantStart

- Stack Overflow

- Street of Walls

- TheStreet

- Wall Street Journal

Books

- Machine Learning for Algorithmic Trading: Predictive models to extract signals from market and alternative data for systematic trading strategies with Python, by Stefan Jansen

- Algorithmic Trading: A Practitioner's Guide, by Jeffrey M Bacidore

- Algorithmic Trading: Step-By-Step Guide to Develop Your Own Winning Trading Strategy Using Financial Machine Learning Without Having to Learn Code, by Investors Press

- Software Engineer or Developer

- Supply Chain Optimization

- Data Analysis in Health Care or Drug Development

- Cyber Security

- Risk Management

Newsfeed

Featured Jobs

Online Courses and Tools