Spotlights

A “portfolio manager” is a type of financial or investment fund manager.

Investment Manager, Asset Manager, Fund Manager, Wealth Manager, Portfolio Analyst, Investment Analyst, Investment Strategist, Portfolio Strategist, Portfolio Specialist, Investment Officer

A Portfolio Manager is responsible for investing funds provided by investors. The fund can be provided by a venture capital firm, mutual funds, hedge fund, or other investment originators. They will decide the best way to invest the money to turn a profit. They select specific investments and execute trades in the market.

- Helping others succeed in investment.

- To succeed, you keep up on current events and make big decisions.

- Well compensated and regarded in this role.

- Challenging work every day.

A portfolio manager can be an individual, or work with a group managing the same portfolio. During their workday they will spend a lot of time in meetings, on the phone, responding to email, or text messages. During this time, they can expect to:

- Study economic trends, as well as current events and how the events may affect financial markets.

- Analyze financial data and its historic performance.

- Analyze company data as well as the company’s individual performance.

- Write reports or create presentations.

- Meet with high-level investors.

- Recommend investments for the funds.

A Portfolio Manager may also choose a more active role in the investments being managed. Passive managers will use data to invest in long-term investments typically understood to grow over time without much interaction. Active managers will trade more often and try to beat the market growth. Investors will decide which type of investment they want their managers to do.

For hedge fund managers

If this is a single-manager hedge fund, then the Portfolio Manager raised the capital and has responsibility for all of it; if it’s a multi-manager fund, he/she was assigned a certain amount of assets under management (AUM) to invest. Regardless of the fund type, the PM makes final trading decisions, monitors risk and the entire portfolio, and oversees back/middle office operations such as compliance, IT, and accounting.

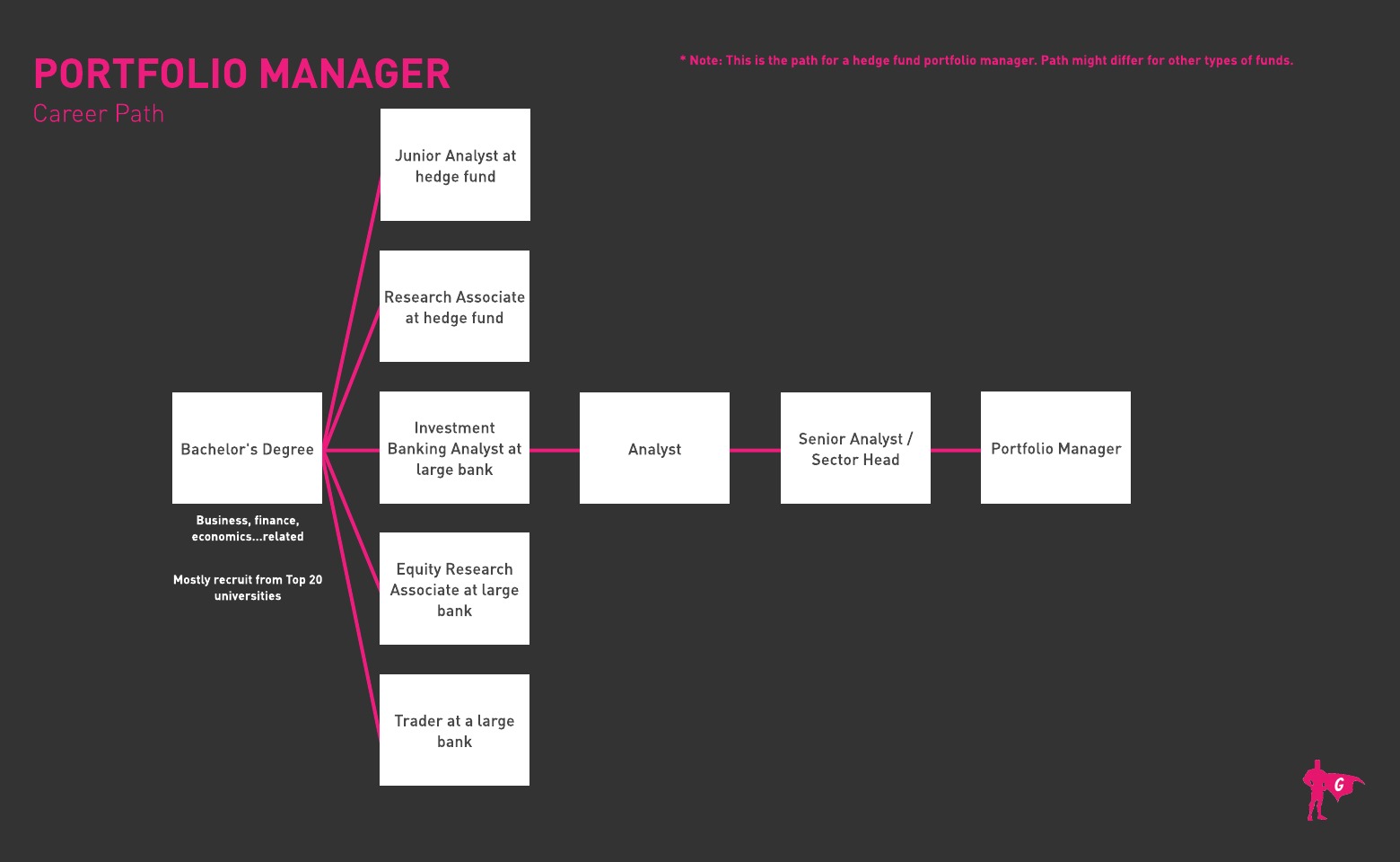

PREVIOUS JOBS BEFORE BECOMING A PORTFOLIO MANAGER:

Analyst Tasks include:

- Monitoring industry and company trends.

- Speaking with management, customers, and suppliers at potential or current portfolio companies.

- Responding to questions from Senior Analysts and Portfolio Managers and explaining/defending your ideas.

- Generating investment ideas.

- Building financial models and valuations to support your ideas.

- Conducting due diligence, often with on-site visits and “channel checks.”

Senior Analyst (Section Head) tasks include:

- Similar tasks to Analyst but additional responsibilities:

- As the alternate names imply, you often specialize in one sector, industry, or strategy.

- You spend more time pitching the Portfolio Managers on your ideas, coming up with ideas, and having Analysts flesh out and support those ideas.

- You spend more time on management – developing Analysts below you to help with work, getting the PMs to trust you, and building a reputation with equity research analysts and management teams.

- Strong written/oral communication skills.

- Excellent at data analysis and understanding data trends.

- Deductive reasoning and understanding complex cause/effect relationships.

- Computer literacy – including word processing, database analysis, and spreadsheets.

- Highly skilled in mathematics, including calculus and statistics.

- Customer Service skills

- Administration and Management.

- Economics and Accounting.

- Wealth Management Firms

- Pension Funds

- Foundations (Endowment Funds)

- Insurance Companies

- Banks

- Hedge Funds

- Securities Companies

Like many financial sector positions, Portfolio Managers work long hours much of the time. This is not an entry level position, so you can expect to work for some time in a different financial analysis position. This means you will have spent time already being successful in one position before moving into another.

Portfolio Managers typically create profit through public securities growth. There is an increase in investment through Private Equity firms which takes some of this potential off the table.

Portfolio Management continues to increase its reliance on data collection and analysis. There is also an increase in technology use as software is able to run more complex predictions on a security’s performance.

There is also an increase in handling items outside the financial scope. Companies are developing stronger environmental concerns and diversity in their human resources. Some portfolio managers are using these concerns to help increase a company’s public perception and profit.

- Scorekeeping for sporting events.

- Math lessons and class.

- Running personal businesses such as lemonade stands.

- Helping run concessions or other business-related activities.

- Portfolio Managers generally hold a bachelor’s degree in finance or a related field

- Common classes include accounting, business, economics, finance, risk management, math, and stock market topics

- Completing an MBA is preferred and will boost your credentials in a competitive job market. A master’s may also qualify you for advanced positions so you won’t have to start at a junior level

- Practical work experience is key; most Portfolio Managers work for years in related roles such as research analysis before being hired for assistant positions

- Internships for analysts and students are also very helpful in preparing for Portfolio Manager duties

- Portfolio Managers should complete a Chartered Financial Analyst certification program

- Certifications such as the Academy of Certified Portfolio Managers’ Chartered Portfolio Manager, offered in conjunction with Columbia University, or Wharton’s Asset and Portfolio Management Certificate Online Course are also useful

- Portfolio Managers may be expected to pass certain Financial Industry Regulatory Authority (FINRA) exams during their careers depending on the scope of their jobs. For large accounts, managers must register with the Securities and Exchange Commission

- Enroll in plenty of math, accounting, finance, statistics, data analytics, computer science, statistics, business law, economics, tax law, and banking classes

- Develop your writing, public speaking, and presentation skills

- Learn how to use common software programs like Personal Capital, Mint, Quicken Premier, Investment Account Manager, Morningstar Portfolio Manager, or SigFig Portfolio Tracker

- Study investment strategies and markets; get ready to put in long hours once you’re hired because Portfolio Managers may work 60+ hours a week and be “on-call” in the event of major events that could affect clients

- Don’t wait to get started gaining practical work experience through research analyst jobs or internships

- Consider working on certifications such as Chartered Financial Analyst, Asset and Portfolio Management Certificate, or Chartered Portfolio Manager

- Keep your LinkedIn profile up-to-date and publish articles to show off your insights

- Write for Medium or submit articles to online financial publications to boost your credentials

- Join professional organizations such as the International Association of Quantitative Finance and the Portfolio Management Institute

- A Portfolio Manager is not an entry level position. You will need to find an entry level position as a financial analyst in a firm, typically a “junior analyst.” These positions are open to bachelor degree candidates. Professionals will spend several years gaining on-the-job experience before returning to school to earn a master’s degree.

- You can also get an Internship during college and it may roll into full-time job, so work hard and show them you’re committed to learning as much as possible

- This, coupled with their job experience, provides them with the background to move into a senior analyst position. This is the individual who works directly for the Portfolio Manager, supervising a small team of Junior Analysts. Eventually, with success, they may move into a Portfolio Manager position.

- Use job portals like eFinancialCareers, Financial Job Bank, Indeed, Simply Hired, Glassdoor, and the Association for Financial Professionals’ job board to find opportunities

- Many people in this field get their jobs by working their way up within their companies, so look for employers you can see yourself working for a long time. Companies don’t want to simply hire people who are looking to get experience then leave for a better job

- Spread the word to your professional network that you’re looking for a Portfolio Manager position

- Check out Job Hero’s resume examples for ideas about what to include, and Zip Recruiters in-depth analysis of the best keywords and skills to include

- Invest in the services of a professional resume writer to take your resume to the next level!

- Study Glassdoor’s Portfolio Manager interview questions before your own interview calls start pouring in

- Once you are a portfolio manager, depending on the size of the firm, you may move into a Senior Portfolio Manager position. For many, this will be the highest position available. However, you may be able to find a leadership position elsewhere or even start your own firm.

The movement from school to Portfolio Manager is straight-forward. You will start at a firm as a junior analyst and work your way up if you demonstrate success. You will be expected to earn a Master’s degree at some point, often while you are working.

Portfolio Manager’s often run several teams via their senior analysts and do not have much room to move up themselves.

Websites

- Barron’s

- Bloomberg

- CNBC Breaking Business News

- Fiduciary & Investment Risk Management Association

- Financial Industry Regulatory Authority

- Financial Times

- Fox Business

- International Association of Quantitative Finance

- MarketWatch

- Portfolio Management Institute

- Street of Walls

- TheStreet

- Wall Street Journal

Books

- The New Dynamic of Portfolio Management: Innovative Methods and Tools for Rapid Results, by Murali Kulathumani MBA

- The Standard for Portfolio Management, by Project Management Institute

- Modern Portfolio Management: Moving Beyond Modern Portfolio Theory, by Todd E. Petzel

- Portfolio Management: Theory and Practice, by Scott D. Stewart, Christopher D. Piros, et al.

- Investment Banker

- Fund Manager

- Corporate Finance

- Venture Capitalist

- Private Equity work

In finance, relationships can be as important as money. During your school and entry-level work it is important to build a strong network. Every person you encounter could be a later reference, so it is important to hone your people skills. Moving up and finding positions is based on who you know, but also on how well you do at your job.

You will need to plan on performing well in finance, as well as likely obtaining a Master’s Degree, to be moved into a senior level at a firm. You will then need to demonstrate further success before obtaining a Portfolio Manager position. However, if you are able to do so, you will be well compensated and be able to move into other financial positions easily if you desire.

Newsfeed

Featured Jobs

Online Courses and Tools