Spotlights

Accredited Financial Counselor, Certified Consumer Credit and Housing Counselor, Certified Credit and Housing Counselor, Certified Credit Consultant, Certified Credit Counselor, Credit Counselor, Financial Health Counselor, Housing Counselor, Personal Finance Counselor

When someone doesn’t have the money they need to purchase something, they often turn to a credit card or take a loan instead. Both are types of credit, but they work a bit differently.

A loan, as the financial app FI explains, is a “lump sum of money borrowed for a specific purpose and repaid in fixed installments with interest.” On the other hand, credit (or a “line of credit”) is “a pre-approved amount of money that can be borrowed and repaid repeatedly within a set credit limit.”

Together, these types of credit make up the financial backbone of our economy. Credit supports everything from buying a new pair of jeans to paying for a car or house. Thus, credit is a very powerful tool that helps people and organizations obtain things when they don’t have the necessary amount of cash to pay upfront.

Credit represents trust. A lender has to believe the person or organization they give credit to will be able to pay the money back. Misused, credit can lead to financial problems and a negative reputation that hurts the borrower’s credit score. When that happens, their interest rates can go up, making it even harder to pay back the debt!

This is where Credit Counselors come in to help clients via debt repayment plans and budgeting strategies, so they can rebuild their credit and regain control over their finances!

- Empowering clients to escape debt and get their finances on track

- Helping clients avoid bankruptcy

- Assisting lenders with recoupment of funds they gave to borrowers

- Improving the financial health and stability of businesses

Working Schedule

- Credit Counselors work full-time jobs, typically during normal business hours, though they may meet with clients after hours, as needed. Occasional travel may be necessary.

Typical Duties

- Schedule consultations with individuals seeking advice on credit management

- Review and assess clients’ financial information, such as income, assets, property values, tax payments, and debts

- Collaborate with financial analysts and property appraisers, as needed

- Evaluate external risks affecting clients’ financial stability

- Utilize financial analysis software to organize and interpret clients’ financial data and provide comprehensive credit counseling

- Explain to clients their financial positions and risk factors in clear terms

- Advise clients on budgeting, saving, credit decisions, measures for managing and consolidating debts, and strategies for credit improvement

- Update clients on changes relevant to their credit status and financial plans (such as college funding, paying medical bills, moving, or retiring)

- Engage in discussions with business owners and/or organizational leaders to align credit counseling practices with overarching goals and priorities

- Explain how to manage tax debt

- Provide financial literacy and consumer assistance resources

- Help clients prevent and recover from identity theft

Additional Responsibilities

- Perform regularly scheduled assessments of clients’ credit accounts to ensure ongoing financial health and stability

- Participate in professional development and training sessions to stay current with industry standards and practices

- Assist clients with unique circumstances, such as military deployments, medical crises, or unemployment

- Develop and update credit counseling policies and procedures to be in line with the industry guidelines

Soft Skills

- Analytical

- Communication skills

- Customer service

- Decisive

- Detail-oriented

- Independent

- Integrity

- Methodical

- Objective

- Organized

- Patient

- Problem-solving

Technical Skills

- Credit evaluation and loan management software

- Customer relationship management software

- Financial modeling and analysis skills

- Risk assessment and management principles

- Spreadsheets

- Banks and financial institutions

- Community development financial institutions

- Consumer credit companies

- Credit unions

- Debt settlement companies

- Educational institutions (for student financial counseling)

- Government agencies

- Independent financial advising firms

- Law firms specializing in bankruptcy or financial law

- Mortgage companies

- Non-profit credit counseling agencies

- Online financial advisory services

- Real estate agencies (for housing-related credit counseling)

With the rise of easy credit access and the complexities of modern financial products, the risk of falling into debt has skyrocketed. That’s why the work of Credit Counselors is more essential than ever. They serve as educators and advocates, raising the financial literacy of their clients who can then make better decisions.

Credit Counselors are invaluable allies in the journey to financial stability and freedom! They help resolve immediate credit issues and lay a crucial foundation for long-term financial wellness. But that means expectations run high, and they have to be extremely diligent because their clients’ livelihoods may depend on their advice.

Rising consumer debt is a major trend, particularly credit card balances and student loans. The ease of access to credit cards and the escalating costs of higher education have contributed to this uptick. What’s more, the allure of “buy now, pay later” services is tempting consumers to spend beyond their means.

Meanwhile, online lending and fintech firms are reshaping small business financing, challenging traditional banks by offering faster, more flexible credit solutions tailored for the small business hustle. With so much credit floating around, more people need the services of Credit Counselors who can help them manage debt and spend wisely.

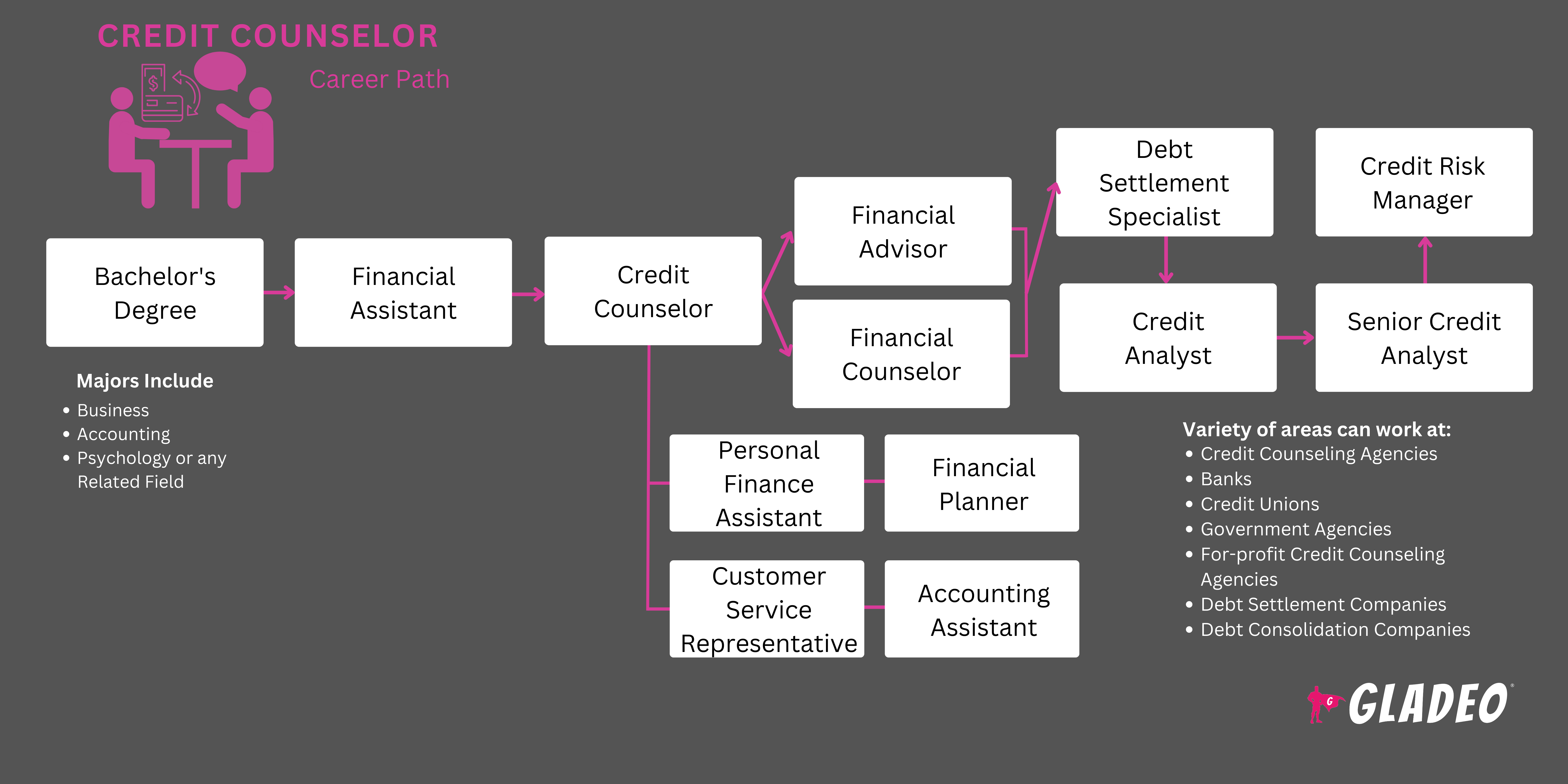

- Credit Counselors typically hold a bachelor’s or master’s degree in finance, accounting, or business

- Entry-level positions in credit management or collections are common starting points, leading to promotions and specialization in credit counseling

- Credit Counselors can work in a wide range of industries, so having specialized industry knowledge is beneficial. This can be gained through a college minor, a certificate, or even ad hoc classes

- On-the-job training is provided by employers, along with additional courses to enhance skills

- Completing a Certified Credit Counselor certification from the National Association of Certified Credit Counselors may enhance one’s qualifications and professional credibility.

- Other education and training options include:

- American Bankers Association’s certifications and courses

- American College of Financial Services’ Chartered Financial Consultant

- Association for Financial Counseling and Planning Education’s Accredited Financial Counselor

- Certified Management Accountant

- Certified Public Accountant

- International Association of Professional Debt Arbitrators’ Certified Debt Arbitrator

- National Association of Certified Student Loan Professionals’s Certified Student Loan Professional

- National Association of Personal Financial Advisors’ Certified Financial Planner

- Students should seek colleges offering majors in accounting, finance, or business

- Look for programs that feature applicable courses in personal finance, debt management, budgeting, bankruptcy counseling, financial education, and various debt types like credit cards, mortgages, and student loans

- See which programs have internships and opportunities to gain practical experience

- Compare the costs of tuition and other fees. Review your options for scholarships and financial aid

- See if the program has any partnerships with companies that hire grads!

- Take note of graduation and job placement statistics for alumni

- High school students should take courses in business, accounting, finance, math, English, communications, information technology, statistics, and speech or debate

- Having banking and credit management experience can be helpful. Look for part-time jobs where you can rack up some relevant work experience

- Apply for relevant internships, through your school or on your own

- Read magazines and online articles related to personal finance, debt management, budgeting, bankruptcy, and various debt types like credit cards, mortgages, and student loans

- Consider doing ad hoc courses via Coursera or other sites to learn more about credit

- Request an informational interview with a working Credit Counselor at a credit counseling agency or financial institutions

- Consider additional courses or certifications in financial planning or counseling

- Network with professionals in the field through informational interviews or job shadowing

- Learn about government programs and policies related to consumer credit and debt relief

- Check out job portals like Indeed.com, LinkedIn, Glassdoor, Monster, CareerBuilder, SimplyHired, or ZipRecruiter

- Utilize job portals like Indeed.com, LinkedIn, Glassdoor, and others for credit counseling positions. Take note of keywords and use them in your resume

- Expect entry-level roles if you're new to the field

- Leverage connections made during internships or educational programs. Use your network to get job tips!

- Ask your instructors, former supervisors, and/or coworkers if they’re willing to serve as personal references (but don’t give out their personal contact information without permission)

- Check out Credit Counselor resume examples and sample interview questions

- Do mock interviews with your school’s career center or friends

- Dress appropriately for interviews and show your enthusiasm for and knowledge of the field

- Focus on your main job first, but let your supervisor know you’re interested in career progression and ask for their advice

- Let them know you are willing to undergo extra training or take classes as needed to become a greater asset to the employer

- Completing certifications or becoming a Certified Public Accountant should enhance your qualifications

- Earning a graduate degree may help to qualify for advancement

- Ensure clients feel taken care of and respected. Explain loan and credit information in a way that is clear and logical

- Resolve client issues quickly and ensure the best outcomes for everyone, including lenders!

- Stay informed about changes in credit laws, debt management strategies, and financial planning

- Volunteer to take on extra duties or responsibilities

- Be proficient in financial analysis tools and customer relationship management software

- For those working at small institutions, you may have to apply to work for a larger organization to make a bigger paycheck or reach larger career goals

Websites

- American Bankers Association

- American College of Financial Services

- Association for Financial Counseling and Planning Education

- Consumer Financial Protection Bureau

- Financial Counseling Association of America

- International Association of Professional Debt Arbitrators

- National Association of Certified Credit Counselors

- National Association of Certified Student Loan Professionals

- National Association of Personal Financial Advisors

- National Foundation for Credit Counseling

- U.S. Department of Housing and Urban Development

Books

- “Credit Repair Kit for Dummies,” by Steve Bucci

- “The Total Money Makeover,” by Dave Ramsey

- “Your Money or Your Life,” by Vicki Robin and Joe Dominguez

Credit Counselors often work with clients facing financial stress, which can be emotionally challenging for the counselors, too! Overexposure to such situations may, in time, lead to burnout and fatigue. If you’re curious about related career options, consider the below similar occupations:

- Accountant and Auditor

- Bankruptcy Advisor

- Budget Analyst

- Consumer Advocate

- Debt Settlement Specialist

- Financial Analyst

- Financial Planner

- Insurance Sales Agent

- Loan Officer

- Personal Financial Advisor

Newsfeed

Featured Jobs

Online Courses and Tools